If you are looking for some of the best investing apps on the market, you’re in the right place. I want to share 4 amazing investment apps that I am using and truly enjoying. Please note they are only listed in alphabetical order, not order or preference.

Acorns

Acorns is a unique investing app that primarily functions as a roundup app. If you are unaware, a roundup app connects to your bank account and whenever you make a purchase, it rounds the charge up to the nearest dollar and invests the difference. For example, if you have a charge of $15.62, it will round up to $16,00 and invest the $0.38. Rather than investing each roundup, it waits until you have accumulated $5.00 then withdraws that money from your account.

bank account and whenever you make a purchase, it rounds the charge up to the nearest dollar and invests the difference. For example, if you have a charge of $15.62, it will round up to $16,00 and invest the $0.38. Rather than investing each roundup, it waits until you have accumulated $5.00 then withdraws that money from your account.

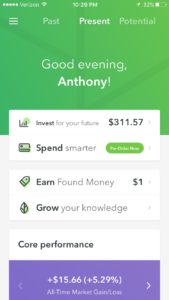

You can also choose to add periodic investments to grow your fund, and Acorns also partners with brands that will offer rewards in terms of additional investments into your account for using them.

The money is invested by Acorn in Exchange Traded Funds (ETF’s) and I have seen a 5.9% growth in my money since I have been using the app.

You can get started for FREE with Acorns and get $5 added to your account by using this link to register.

Bumped

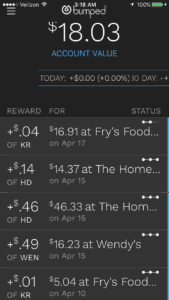

Bumped is one of the coolest investment apps on the market. Why? It’s because with Bumped, you actually get FREE Stock just for shopping at certain stores. I don’t fully understand the business model, but it essentially functions as a loyalty program, but instead of getting discounts or cash back, you get fractional shares of stock. The best part is that it does not minimize and other reward programs, so for example at a grocery store, you would still get your discounts and fuel points and if you use a rewards credit card, you still get those rewards.

Bumped allows you to pick a stock in a few different categories such as burgers, coffee, gas, drug stores, family dining, and a few  others. The idea is that you have to pick one brand in each category and you are rewarded for your loyalty to that store. For example, I chose Starbucks over Dunkin’ Donuts in the coffee category, and I chose Home Depot in the home improvement. The idea is that I will prefer those companies over others when I shop because every time I shop, I get a fractional share of stock in the company. I have to say, it felt pretty neat to walk into Starbucks as a shareholder (albeit a very small one at this stage.)

others. The idea is that you have to pick one brand in each category and you are rewarded for your loyalty to that store. For example, I chose Starbucks over Dunkin’ Donuts in the coffee category, and I chose Home Depot in the home improvement. The idea is that I will prefer those companies over others when I shop because every time I shop, I get a fractional share of stock in the company. I have to say, it felt pretty neat to walk into Starbucks as a shareholder (albeit a very small one at this stage.)

Bumped is still in beta, but you can get on the wait list by being invited by me. All you have to do is click this link to get on the list.

Once you have been selected, they will ask you to register and complete your profile. They need the profile information because they are a genuine investment firm and you will receive official stockholder correspondence through Bumped including any tax forms. When I joined, I was also awarded $10 in free stock just for joining.

Robinhood

Robinhood is an app that allows you to buy and sell stock with no fees. They offer a free share of stock just for signing up using this link, so at a minimum, you should register to get your free share. If you want to buy stock or ETF’s, you can do so on Robinhood without paying fees. You do have to purchase whole shares, as the platform does not support fractional shares.

I was curious as to how Robinhood made money, so I did some research and found that they get paid for their premium account (Robinhood Gold), earn interest from un-invested cash in customer advanced, and also earn money on what is called order flow, which essentially means that they don’t perform the transactions but rather sell the orders to larger entities that do and earn a small fee for each transaction. Some call this practice controversial, and others just enjoy the benefits.

Click here to sign up for your free Robinhood account and claim your free share of stock – no additional purchase required.

Worthy Capital

Worth is a financial technology company that allows investors to earn a steady 5% return on their money. It’s one of the best investment options out there for security and low point of entry. You can buy a Worthy bond for just $10, but buying just one bond won’t really help you see solid returns. A few great features of Worthy are:

- Round-Up Feature – You can round up your expenses (similar to Acorns) and every time you accrue $10, another bond is purchased for you.

- Recurring Investment Option – Simply buying one $10 bond won’t be very exciting in terms of seeing growth on your money. If you want to maximize your growth, this is a great option where you can set a recurring monthly purchase of a set number of bonds.

- Reinvestment Option – As you earn your 5% interest, every time you reach $10 in interest earnings, a new bond is added to your account.

- Referral Program – You can refer people to Worthy and receive a free bond when they join.

- Bonus Bonds – From time to time the company will offer bonus bond for making a purchase. For example, recently they offered a 1% bonus on any bond purchases over $1,000, essentially bringing your return to 6% for the first year of investment.

When I first heard of Worthy I was intrigued and I had the privilege of meeting the company Founder (Sally Outlaw) at FinCon where we discussed their business model, which provides security measures to minimize risks for investors.

You can earn a free $10 bond by using this link and opening an account with a (one time) $200 investment (a purchase of 20 bonds). You can also start small and grow your account to $200, however you won’t get the free bond until your account reaches $200. Please note that you need to keep the account open for 6 months to keep the bonus bond. I don’t think you will want to close the account anyhow once you see how it outperforms your savings account.

If you want to learn more about Worthy, you can read my exclusive review of Worthy Bonds.

Please note that any of the above offers are subject to change at any time as I have no control over them. I am simply sharing the information, so take advantage of them while they are here.

Happy investing!