Chances are that you have heard of the Acorns Investing App and found this article while seeking to find more information about it. I wrote this review not because anyone paid me to, but because I am an avid user of the Acorns app and a financial coach who likes to recommend great tools.

So what does the Acorns investing app do? It is an app that gives you several options to invest, and best of all, most of them are passive.

Features of the Acorns Investing App

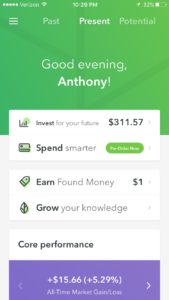

Round-Up Investing – I first started using the Acorns app because I liked the idea of having a way to save that was passive, and  the Acorns apps does this through it’s “round up†feature. I believe this was the initial function of the app until they expanded into other offerings. To leverage the round-ups feature, you simply (and securely) connect your bank account to the app, and anytime you spend money it will round up the charge and put the difference in your investing account. For example, if you have a charge of $15.35, the app will allocate $0.65 to your investing account and when the round ups total $5, the app will transfer the money to your investing account. This money really adds up over time and within a few months, I had a few hundred dollars in the account AND it had grown due to interest paid out on my investments. Acorns charges a nominal fee of $1 per month for this service, known as “Invest for your future.â€

the Acorns apps does this through it’s “round up†feature. I believe this was the initial function of the app until they expanded into other offerings. To leverage the round-ups feature, you simply (and securely) connect your bank account to the app, and anytime you spend money it will round up the charge and put the difference in your investing account. For example, if you have a charge of $15.35, the app will allocate $0.65 to your investing account and when the round ups total $5, the app will transfer the money to your investing account. This money really adds up over time and within a few months, I had a few hundred dollars in the account AND it had grown due to interest paid out on my investments. Acorns charges a nominal fee of $1 per month for this service, known as “Invest for your future.â€

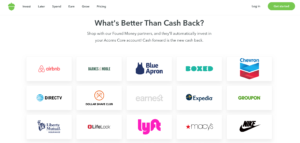

Found Money – This is a cool feature where you can earn money in your account simply by making  purchases through certain vendors. All you need to do is have a credit or debit card on file in the app and when you shop at any of the many vendors in the program you will earn cash back. Here is a screenshot showing several of Acorns partner vendors where you can earn “found money.†The Found Money feature is included with the “Invest for your future†service, so there is no additional cost to take advantage of this feature.

purchases through certain vendors. All you need to do is have a credit or debit card on file in the app and when you shop at any of the many vendors in the program you will earn cash back. Here is a screenshot showing several of Acorns partner vendors where you can earn “found money.†The Found Money feature is included with the “Invest for your future†service, so there is no additional cost to take advantage of this feature.

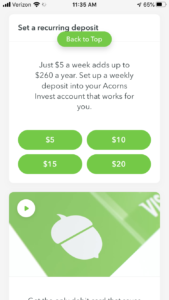

Recurring Deposits – You can also grow your investments with Acorns by setting a weekly recurring deposit of $5, $10, $15, or $20. You can choose to do this in addition to your round-ups or exclusive of them if you want to have a bit more control over how  much you invest monthly. Recurring Deposit are also included with the “Invest for your future†service, so there is no additional cost to take advantage of this feature.

much you invest monthly. Recurring Deposit are also included with the “Invest for your future†service, so there is no additional cost to take advantage of this feature.

Acorns Later (Retirement) – With this feature, you can open an IRA (Individual Retirement Account) via Acorns. You can choose a Traditional or Roth, and start with as little as $5, and set a monthly recurring investment to put your retirement on autopilot. There is an additional $1 per month fee to add this service, known as “Later starts todayâ€.

Spend Smarter – Acorns even has a banking feature where you can open a bank account through Acorns. This account offers solid features including:

- No minimum balance

- No ATM fees

- No overdraft fee

- 10% bonus investments from select local business

There is an additional $1 per month cost for the banking (Spend Smarter) feature (so $3 per month total for all services offered by Acorns.)

Referral Bonuses – Another great way to earn money with Acorns is by referring others to the app. Acorns will pay you $5 referral fee for anyone who you refer that signs up and makes an investment of any kind (Round Ups or Recurring). The good news is that Acorns will give you an initial $5 in your account as well if you use this link to sign up.

** Special February Offer **

If at least 5 people sign up by the end of February using my referral link, I will give my referral fees away for those first 5 people in the form of a $25 Amazon gift card. All you need to do is sign up, and forward your confirmation that you have made an investment to my email address (anthony-at-fiscallysound,com) to enter and I will pick someone at random. Don’t forget you will get an initial $5 investment just by using my referral link to sign up.

What Investment Options Are Available Through Acorns?

The money in your Acorn’s account can be invested in Acorn’s ETF’s (Exchange Traded Funds) which are holding of stock and/or bonds. The performance typically replicates an asset class or an index such as the S&P 500 or the Dow Jones Industrial Average. You can choose whether or not you want to invest in a range of risk within the ETF’s from conservative to aggressive. You should also know that Acorns portfolios are developed with help from Nobel Prize-winning economist, Dr. Harry Markowitz.

Acorns Gives Back

Acorns is also a company that invests in the community by planting Oak trees across America to restore areas affected by forest fires and floods. In doing so, they are creating jobs, stabilizing the climate, and rebuilding habitats for biodiversity. By investing in Acorns, not only do you win, but you are a part of a movement that is making a difference.

What are you waiting for? Click here to get signed up with Acorns today!